29.05.2021 New Publication: Responses of REITs Index and Commercial Property Prices to Economic Uncertainties

In a joint study, Professor Farzanegan with his colleagues from Swinburne University of Technology & Western Sydney University have examined responses of REITs Index and commercial property prices to economic uncertainties. This study is in press at Research in International Business and Finance.

Abstract

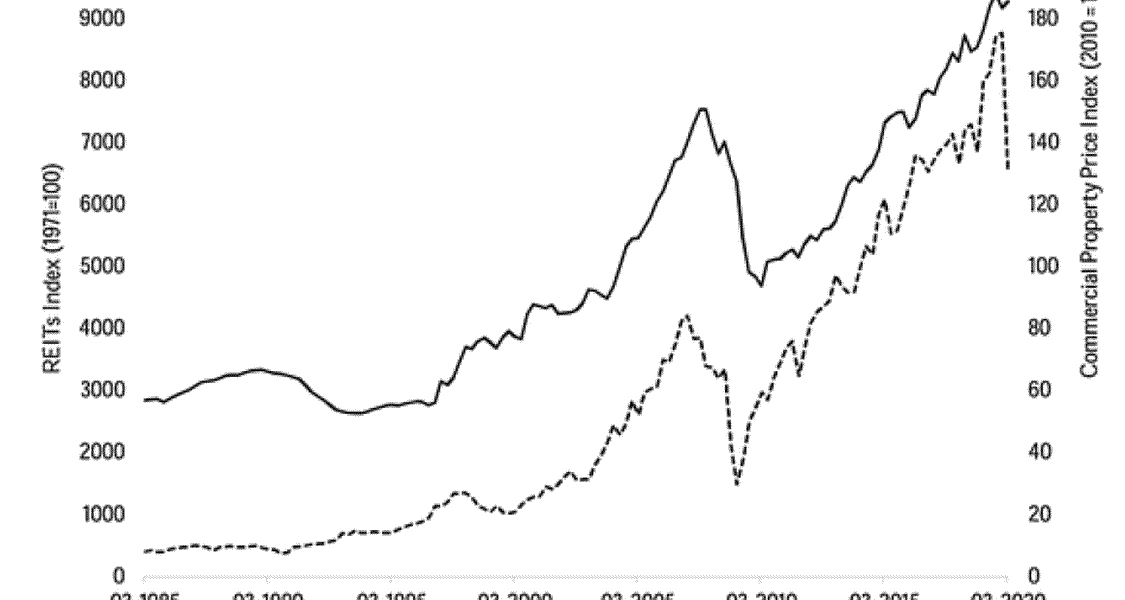

We use market participants’ perceived uncertainty to investigate the response of real estate investment trusts index (REITs Index) and commercial property prices to shocks in economic uncertainty. Using US quarterly data and applying a vector autoregression (VAR) model, our results show that an increase in market participants’ perceived uncertainty leads to a significant drop in the REITs Index and commercial property prices. In addition, we show that the REITs Index responds quicker to the uncertainty shocks than the commercial property prices. Our findings provide important implications for investors.

Keywords: Commercial Property; REITs; COVID-19; Uncertainty; VAR

The study is available at: https://doi.org/10.1016/j.ribaf.2021.101457

Contact

Prof. Dr. Farzanegan